JPMorganChase scales high-quality carbon dioxide removal and strengthens the voluntary carbon market

To help scale high-quality carbon removal, JPMorganChase is working with Carbon Direct on a science-backed diligence, procurement, and carbon removal strategy through 2030 and beyond.

JPMorganChase scales high-quality carbon dioxide removal and strengthens the voluntary carbon market

To help scale high-quality carbon removal, JPMorganChase is working with Carbon Direct on a science-backed diligence, procurement, and carbon removal strategy through 2030 and beyond.

JPMorganChase scales high-quality carbon dioxide removal and strengthens the voluntary carbon market

To help scale high-quality carbon removal, JPMorganChase is working with Carbon Direct on a science-backed diligence, procurement, and carbon removal strategy through 2030 and beyond.

Overview

About JPMorganChase

JPMorganChase is one of the largest financial institutions in the world. As a leader in investment banking, financial services, commercial banking, and more, JPMorganChase recognizes the role that finance has to play in advancing the transition to a low-carbon economy. JPMorganChase is purchasing carbon dioxide removal (CDR) in an effort to match every tonne of its unabated direct operational emissions.

As part of their effort to enable the transition to a low-carbon economy, JPMorganChase strives to minimize the environmental impact of its own operations. This includes addressing residual operational GHG emissions through the purchase of high-quality carbon removals and reducing their Scope 1 and Scope 2 emissions by 40% by 2030 (as compared to a 2017 baseline). JPMorganChase also aims to address long-standing quality concerns in the voluntary market, as well as support needed innovation and the scale-up of carbon removal projects. In 2023, JPMorganChase announced a series of long-term agreements to purchase over $200 million in high-quality, durable CDR. These agreements are expected to enable JPMorganChase to match every tonne of unabated direct operational emissions with durable carbon removal by 2030.

JPMorganChase is uniquely positioned to help speed the development and commercialization of high-quality carbon removal technologies in the voluntary carbon market. With the capital and expertise we have, we can not only finance the promising technologies needed to accelerate the low-carbon transition, but also send a strong market signal.

Taylor Wright

Head of Operational Decarbonization, JPMorganChase

Building a carbon removal procurement strategy for 2030+

JPMorganChase worked with Carbon Direct to strengthen their multi-year carbon removal procurement strategy through 2030, utilizing Carbon Direct’s science-based approach.

“Our top priority in developing our carbon removal strategy is to procure credits that will actually have an impact,” says Wright. “We decided to work with Carbon Direct because we value their extensive expertise in decarbonization, the range of carbon removal pathways, and risk mitigation.”

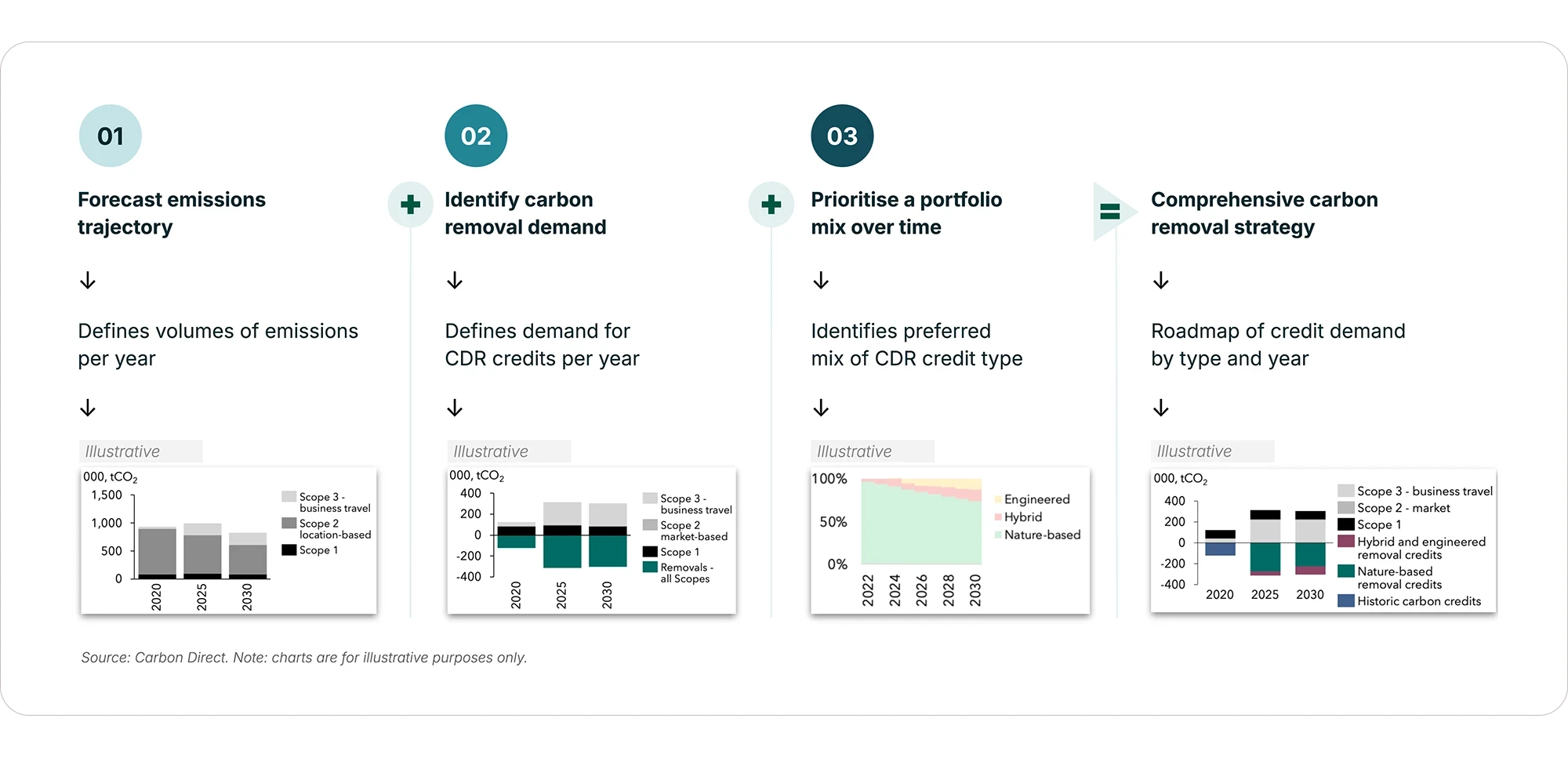

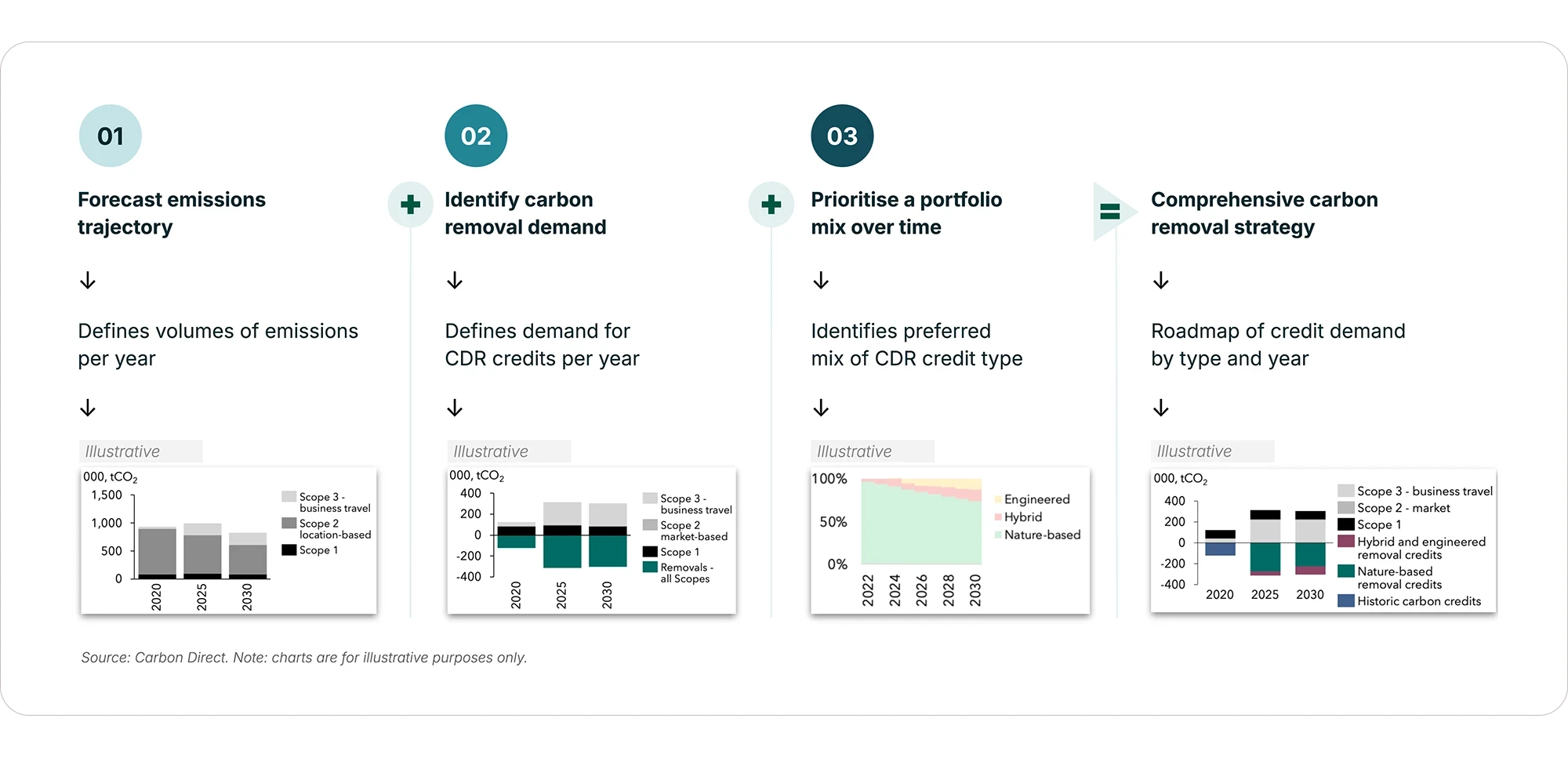

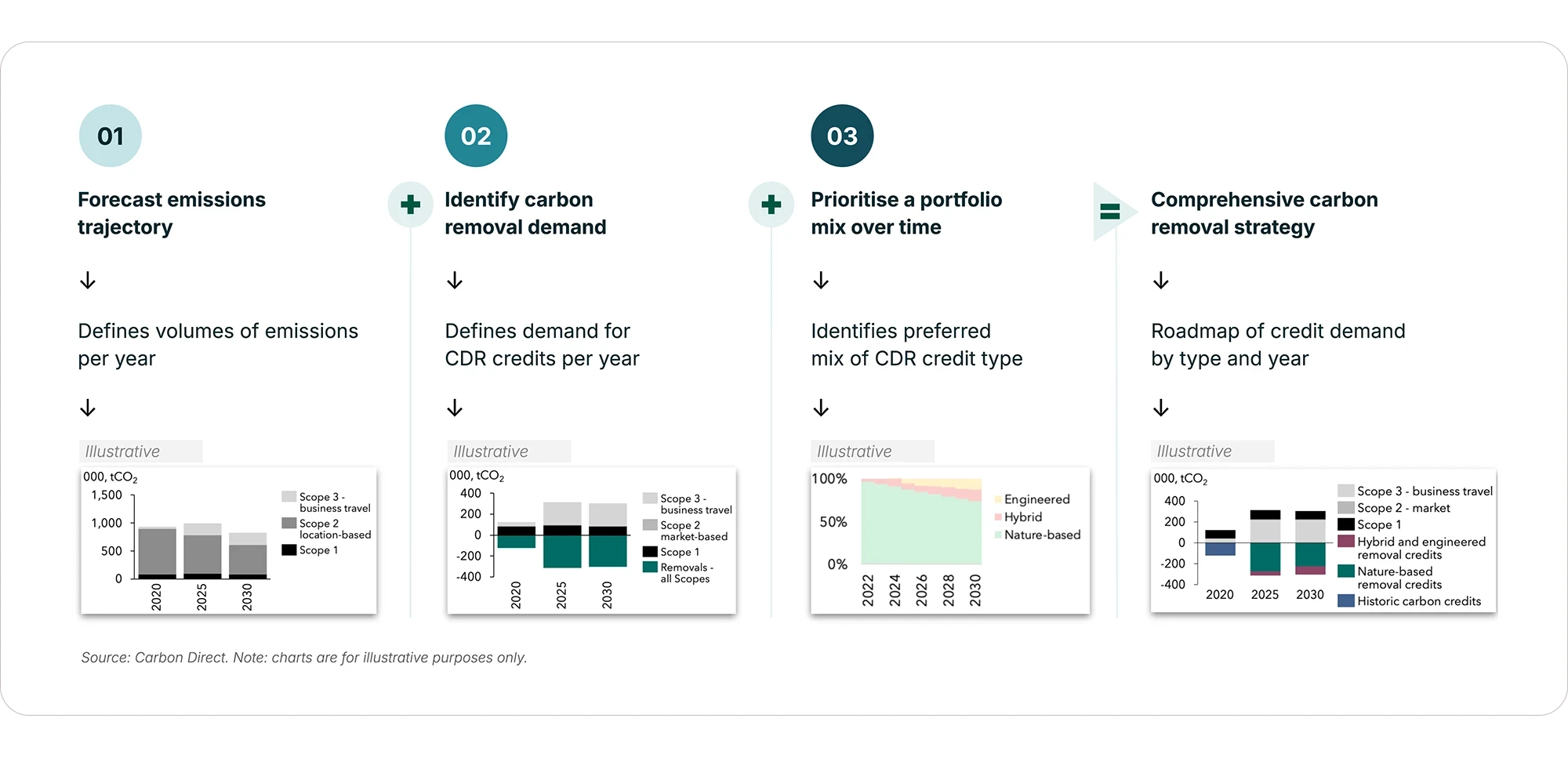

The Carbon Direct team started with a carbon removal scenario analysis for JPMorganChase. This involved testing the different underlying assumptions for their decarbonization trajectory, climate impact goals, carbon removal demand, and desired credit portfolio mix. From there, JPMorganChase was able to identify a procurement scenario that aligned with their operational priorities and targets. This scenario established the foundation of a tailor-made carbon removal strategy that maps specific actions needed to meet their goals for 2030 and beyond.

In addition, the Carbon Direct team helped JPMorganChase understand risk mitigation for the carbon removal technologies under consideration. Whether it’s reforestation or direct air capture, each carbon removal solution has a set of risks specific to their environment, implementation, and management. These can include:

Purchasing risks: where demand for limited high-quality credits drive buyer competition and increase the average credit price; and

Reputational risks: where low-quality credits fail to deliver on their climate impact claims and negatively impact a company’s brand.

Carbon Direct helped JPMorganChase to identify these risks in their carbon removal procurement and mitigate them through a comprehensive strategy to employ technical diligence, portfolio diversification across different carbon removal types, and transparent communication of data-backed climate claims.

“As a corporate buyer, I rely on the scientists like those at Carbon Direct,” says Wright. “I encourage buyers to realize that you don’t have to go it alone. There are experts out there that can help you identify which projects are high-quality and which are not.”

Image source:

Weyerhaeuser

Technical diligence for future carbon removal procurement

In addition to carbon removal procurement strategy work, Carbon Direct provides ongoing technical diligence support to JPMorganChase for new carbon removal projects and technologies for future procurement.

For each project or technology under consideration by JPMorganChase, Carbon Direct applies a proprietary framework to evaluate quality against the Criteria for High-Quality Carbon Dioxide Removal. These evaluations include project strengths, weaknesses, red flags, costs, and other considerations that determine high-quality environmental impact.

By working with Carbon Direct, JPMorganChase is able to access our in-house scientific experts that include licensed professional engineers and chartered project management professionals who have performed hundreds of evaluations for different decarbonization technologies, services, and facilities. This expertise will allow JPMorganChase to continue to strategically canvass the voluntary carbon market to identify the highest-integrity projects that will help them deliver on their climate goals.

“Carbon Direct has become an important part of our diligence process today,” says Wright. “With their deep bench of scientists, they help us make informed purchasing decisions with confidence.”

Looking ahead: advancing high-integrity climate action in the VCM

Beyond evaluating and purchasing carbon removal credits as a part of their own carbon management program, JPMorganChase has published a set of Carbon Market Principles to help corporate buyers effectively direct capital to impactful climate solutions. The publication draws on JPMorganChase’s 10+ years of experience in the voluntary carbon market on how to scale real decarbonization solutions through science-based, actionable criteria.

JPMorganChase, as one of the world’s largest financial institutions, recognizes their role in engaging with the carbon market and ability to model procurement strategies that can be successfully implemented by companies across industries. They are helping buyers and sellers continue to align on the evolving attributes that define high-quality credits, driving demand for high-quality projects, and channeling financing to help stimulate the development of additional carbon removal projects.

“The world needs significant investment to help mitigate the risks associated with climate change and support a healthy economy,” says Brian DiMarino, Managing Director, Deputy Director of Global Sustainability at JPMorganChase. “We hope that our contributions will help to incentivize innovation and catalyze further investment from every industry.”

Learn More:

“

We decided to work with Carbon Direct because we value their extensive expertise in decarbonization, the range of carbon removal pathways, and risk mitigation.

Taylor Wright

Head of Operational Decarbonization, JPMorganChase

Overview

About JPMorganChase

JPMorganChase is one of the largest financial institutions in the world. As a leader in investment banking, financial services, commercial banking, and more, JPMorganChase recognizes the role that finance has to play in advancing the transition to a low-carbon economy. JPMorganChase is purchasing carbon dioxide removal (CDR) in an effort to match every tonne of its unabated direct operational emissions.

As part of their effort to enable the transition to a low-carbon economy, JPMorganChase strives to minimize the environmental impact of its own operations. This includes addressing residual operational GHG emissions through the purchase of high-quality carbon removals and reducing their Scope 1 and Scope 2 emissions by 40% by 2030 (as compared to a 2017 baseline). JPMorganChase also aims to address long-standing quality concerns in the voluntary market, as well as support needed innovation and the scale-up of carbon removal projects. In 2023, JPMorganChase announced a series of long-term agreements to purchase over $200 million in high-quality, durable CDR. These agreements are expected to enable JPMorganChase to match every tonne of unabated direct operational emissions with durable carbon removal by 2030.

JPMorganChase is uniquely positioned to help speed the development and commercialization of high-quality carbon removal technologies in the voluntary carbon market. With the capital and expertise we have, we can not only finance the promising technologies needed to accelerate the low-carbon transition, but also send a strong market signal.

Taylor Wright

Head of Operational Decarbonization, JPMorganChase

Building a carbon removal procurement strategy for 2030+

JPMorganChase worked with Carbon Direct to strengthen their multi-year carbon removal procurement strategy through 2030, utilizing Carbon Direct’s science-based approach.

“Our top priority in developing our carbon removal strategy is to procure credits that will actually have an impact,” says Wright. “We decided to work with Carbon Direct because we value their extensive expertise in decarbonization, the range of carbon removal pathways, and risk mitigation.”

The Carbon Direct team started with a carbon removal scenario analysis for JPMorganChase. This involved testing the different underlying assumptions for their decarbonization trajectory, climate impact goals, carbon removal demand, and desired credit portfolio mix. From there, JPMorganChase was able to identify a procurement scenario that aligned with their operational priorities and targets. This scenario established the foundation of a tailor-made carbon removal strategy that maps specific actions needed to meet their goals for 2030 and beyond.

In addition, the Carbon Direct team helped JPMorganChase understand risk mitigation for the carbon removal technologies under consideration. Whether it’s reforestation or direct air capture, each carbon removal solution has a set of risks specific to their environment, implementation, and management. These can include:

Purchasing risks: where demand for limited high-quality credits drive buyer competition and increase the average credit price; and

Reputational risks: where low-quality credits fail to deliver on their climate impact claims and negatively impact a company’s brand.

Carbon Direct helped JPMorganChase to identify these risks in their carbon removal procurement and mitigate them through a comprehensive strategy to employ technical diligence, portfolio diversification across different carbon removal types, and transparent communication of data-backed climate claims.

“As a corporate buyer, I rely on the scientists like those at Carbon Direct,” says Wright. “I encourage buyers to realize that you don’t have to go it alone. There are experts out there that can help you identify which projects are high-quality and which are not.”

Image source:

Weyerhaeuser

Technical diligence for future carbon removal procurement

In addition to carbon removal procurement strategy work, Carbon Direct provides ongoing technical diligence support to JPMorganChase for new carbon removal projects and technologies for future procurement.

For each project or technology under consideration by JPMorganChase, Carbon Direct applies a proprietary framework to evaluate quality against the Criteria for High-Quality Carbon Dioxide Removal. These evaluations include project strengths, weaknesses, red flags, costs, and other considerations that determine high-quality environmental impact.

By working with Carbon Direct, JPMorganChase is able to access our in-house scientific experts that include licensed professional engineers and chartered project management professionals who have performed hundreds of evaluations for different decarbonization technologies, services, and facilities. This expertise will allow JPMorganChase to continue to strategically canvass the voluntary carbon market to identify the highest-integrity projects that will help them deliver on their climate goals.

“Carbon Direct has become an important part of our diligence process today,” says Wright. “With their deep bench of scientists, they help us make informed purchasing decisions with confidence.”

Looking ahead: advancing high-integrity climate action in the VCM

Beyond evaluating and purchasing carbon removal credits as a part of their own carbon management program, JPMorganChase has published a set of Carbon Market Principles to help corporate buyers effectively direct capital to impactful climate solutions. The publication draws on JPMorganChase’s 10+ years of experience in the voluntary carbon market on how to scale real decarbonization solutions through science-based, actionable criteria.

JPMorganChase, as one of the world’s largest financial institutions, recognizes their role in engaging with the carbon market and ability to model procurement strategies that can be successfully implemented by companies across industries. They are helping buyers and sellers continue to align on the evolving attributes that define high-quality credits, driving demand for high-quality projects, and channeling financing to help stimulate the development of additional carbon removal projects.

“The world needs significant investment to help mitigate the risks associated with climate change and support a healthy economy,” says Brian DiMarino, Managing Director, Deputy Director of Global Sustainability at JPMorganChase. “We hope that our contributions will help to incentivize innovation and catalyze further investment from every industry.”

Learn More:

“

We decided to work with Carbon Direct because we value their extensive expertise in decarbonization, the range of carbon removal pathways, and risk mitigation.

Taylor Wright

Head of Operational Decarbonization, JPMorganChase

Overview

About JPMorganChase

JPMorganChase is one of the largest financial institutions in the world. As a leader in investment banking, financial services, commercial banking, and more, JPMorganChase recognizes the role that finance has to play in advancing the transition to a low-carbon economy. JPMorganChase is purchasing carbon dioxide removal (CDR) in an effort to match every tonne of its unabated direct operational emissions.

As part of their effort to enable the transition to a low-carbon economy, JPMorganChase strives to minimize the environmental impact of its own operations. This includes addressing residual operational GHG emissions through the purchase of high-quality carbon removals and reducing their Scope 1 and Scope 2 emissions by 40% by 2030 (as compared to a 2017 baseline). JPMorganChase also aims to address long-standing quality concerns in the voluntary market, as well as support needed innovation and the scale-up of carbon removal projects. In 2023, JPMorganChase announced a series of long-term agreements to purchase over $200 million in high-quality, durable CDR. These agreements are expected to enable JPMorganChase to match every tonne of unabated direct operational emissions with durable carbon removal by 2030.

JPMorganChase is uniquely positioned to help speed the development and commercialization of high-quality carbon removal technologies in the voluntary carbon market. With the capital and expertise we have, we can not only finance the promising technologies needed to accelerate the low-carbon transition, but also send a strong market signal.

Taylor Wright

Head of Operational Decarbonization, JPMorganChase

Building a carbon removal procurement strategy for 2030+

JPMorganChase worked with Carbon Direct to strengthen their multi-year carbon removal procurement strategy through 2030, utilizing Carbon Direct’s science-based approach.

“Our top priority in developing our carbon removal strategy is to procure credits that will actually have an impact,” says Wright. “We decided to work with Carbon Direct because we value their extensive expertise in decarbonization, the range of carbon removal pathways, and risk mitigation.”

The Carbon Direct team started with a carbon removal scenario analysis for JPMorganChase. This involved testing the different underlying assumptions for their decarbonization trajectory, climate impact goals, carbon removal demand, and desired credit portfolio mix. From there, JPMorganChase was able to identify a procurement scenario that aligned with their operational priorities and targets. This scenario established the foundation of a tailor-made carbon removal strategy that maps specific actions needed to meet their goals for 2030 and beyond.

In addition, the Carbon Direct team helped JPMorganChase understand risk mitigation for the carbon removal technologies under consideration. Whether it’s reforestation or direct air capture, each carbon removal solution has a set of risks specific to their environment, implementation, and management. These can include:

Purchasing risks: where demand for limited high-quality credits drive buyer competition and increase the average credit price; and

Reputational risks: where low-quality credits fail to deliver on their climate impact claims and negatively impact a company’s brand.

Carbon Direct helped JPMorganChase to identify these risks in their carbon removal procurement and mitigate them through a comprehensive strategy to employ technical diligence, portfolio diversification across different carbon removal types, and transparent communication of data-backed climate claims.

“As a corporate buyer, I rely on the scientists like those at Carbon Direct,” says Wright. “I encourage buyers to realize that you don’t have to go it alone. There are experts out there that can help you identify which projects are high-quality and which are not.”

Image source:

Weyerhaeuser

Technical diligence for future carbon removal procurement

In addition to carbon removal procurement strategy work, Carbon Direct provides ongoing technical diligence support to JPMorganChase for new carbon removal projects and technologies for future procurement.

For each project or technology under consideration by JPMorganChase, Carbon Direct applies a proprietary framework to evaluate quality against the Criteria for High-Quality Carbon Dioxide Removal. These evaluations include project strengths, weaknesses, red flags, costs, and other considerations that determine high-quality environmental impact.

By working with Carbon Direct, JPMorganChase is able to access our in-house scientific experts that include licensed professional engineers and chartered project management professionals who have performed hundreds of evaluations for different decarbonization technologies, services, and facilities. This expertise will allow JPMorganChase to continue to strategically canvass the voluntary carbon market to identify the highest-integrity projects that will help them deliver on their climate goals.

“Carbon Direct has become an important part of our diligence process today,” says Wright. “With their deep bench of scientists, they help us make informed purchasing decisions with confidence.”

Looking ahead: advancing high-integrity climate action in the VCM

Beyond evaluating and purchasing carbon removal credits as a part of their own carbon management program, JPMorganChase has published a set of Carbon Market Principles to help corporate buyers effectively direct capital to impactful climate solutions. The publication draws on JPMorganChase’s 10+ years of experience in the voluntary carbon market on how to scale real decarbonization solutions through science-based, actionable criteria.

JPMorganChase, as one of the world’s largest financial institutions, recognizes their role in engaging with the carbon market and ability to model procurement strategies that can be successfully implemented by companies across industries. They are helping buyers and sellers continue to align on the evolving attributes that define high-quality credits, driving demand for high-quality projects, and channeling financing to help stimulate the development of additional carbon removal projects.

“The world needs significant investment to help mitigate the risks associated with climate change and support a healthy economy,” says Brian DiMarino, Managing Director, Deputy Director of Global Sustainability at JPMorganChase. “We hope that our contributions will help to incentivize innovation and catalyze further investment from every industry.”

Learn More:

“

We decided to work with Carbon Direct because we value their extensive expertise in decarbonization, the range of carbon removal pathways, and risk mitigation.

Taylor Wright

Head of Operational Decarbonization, JPMorganChase

Connect with an expert

Get answers to your decarbonization questions and explore carbon management solutions.

Connect with an expert

Get answers to your decarbonization questions and explore carbon management solutions.

Connect with an expert

Get answers to your decarbonization questions and explore carbon management solutions.