On March 10th, the United States (U.S.) Senate passed the Consolidated Appropriations Act, 2022 that will fund the federal government through fiscal year 2022. This omnibus legislation provides the largest increase in non-defense funding in four years, allocating $1.5 trillion across the U.S. federal government. The passage of this policy will unlock funding for many of the programs in the bipartisan Infrastructure Investment and Jobs Act (IIJA) - providing additional support for hydrogen projects, carbon dioxide removal (CDR) projects, and carbon management infrastructure. This funding is critical to scale and advance the carbon removal market in the United States - and has been long awaited.

Why We Need Policy Support for Decarbonization

In 2018, the Intergovernmental Panel on Climate Change (IPCC) released a special report on the projected impacts of global warming and an analysis of carbon reduction and mitigation pathways. This report finds that “all pathways that limit global warming to 1.5C with limited or no overshoot project the use of CDR on the order of 100 to 1000 Gt CO2 over the 21st century.” This scale of removal is attainable, but the current global rate of CDR deployment and the implementation of emissions reductions strategies are falling short of meeting the goals established in the Paris Agreement.

Public policy plays a key role in advancing the CDR market in that it can provide fiscal incentives that increase profitability of CDR projects, standardize emissions analyses across sectors and organizations, provide support for research, development and deployment of CDR novel technologies, and regulate the quality of CDR projects across the market. Examples of strong public policies that support CDR and carbon management in the U.S. include California’s Low Carbon Fuel Standard and the Carbon Sequestration Tax Credit under Section 45Q of the U.S. Tax Code.

How the Infrastructure Investment and Jobs Act Paves the Road to Net-Zero

The IIJA, enacted in November 2021, provides the largest federal government investment in climate solutions in U.S. history. This legislation dedicates $62 billion for the U.S. Department of Energy (DOE) for the advancement of an equitable clean energy future. Among the allocations, it will provide about $6.5 billion for carbon management projects, specifically direct air capture (DAC) and carbon capture, utilization, and sequestration (CCUS) projects, between fiscal years 2022-2026. Over the same time period, this Act will provide an additional $3.5 billion for large carbon capture pilots and demonstrations and $8 billion for hydrogen hubs. In addition, $3.5 billion will be dedicated to supporting four regional DAC Hubs, $115 million for a DAC Technology Prize Competition, $310 million for a Carbon Utilization Program, and $2.1 billion for carbon dioxide transportation infrastructure.

In addition to being the largest federal government investment in climate solutions in U.S. history, this legislation is notable in that it demonstrates the federal government’s strong support for CDR, which will be essential for meeting the country’s net-zero by 2050 goals. The investments in carbon storage, utilization, and carbon transport infrastructure will improve the durability of removed carbon, therefore improving overall quality of connected CDR projects.

Over the past two decades, the majority of the investment in CDR technologies and carbon reduction pathways in the U.S. was led by the voluntary actions of private organizations in tandem with regional and state initiatives. While great progress has been made, cooperation across the private and public sectors at all levels is critical. The support for CDR and carbon reduction pathways in these two recent legislations will accelerate the country’s progress towards its climate goals.

What the Consolidated Appropriations Act Means for Carbon Removal

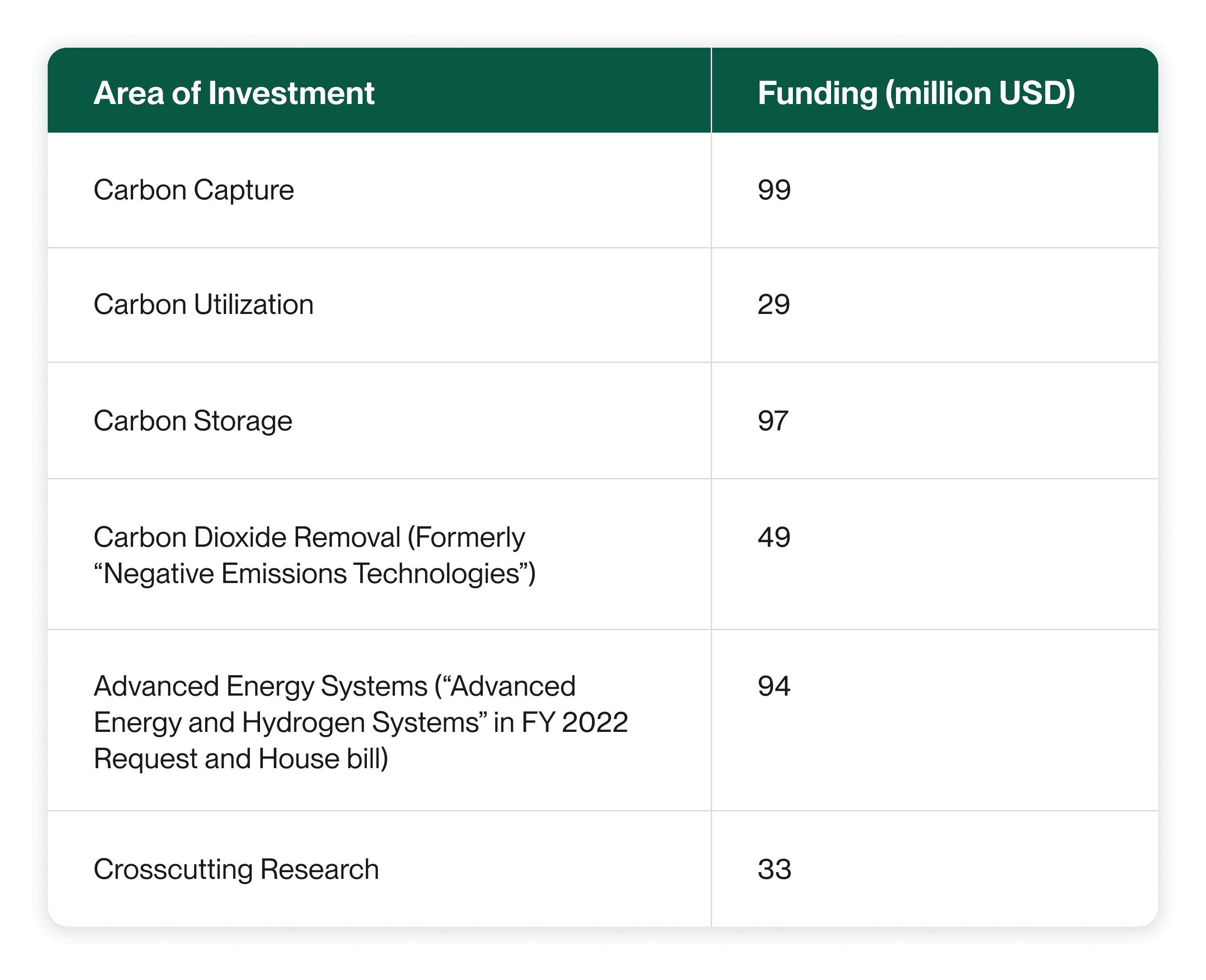

Building on the IIJA, this omnibus legislation will direct $2 billion towards the deployment or improvement of existing and new fossil-fueled electric generating plants that utilize carbon sequestration and utilization systems. Until September 30, 2023, $825 million will be allocated to the Department of Energy’s Office of Fossil Energy and Carbon Management (FECM) for the advancement of carbon reduction and mitigation pathways and technologies. This amount is dedicated to the research and development of a number of carbon capture and removal pathways, including oceans-based CDR, bioenergy with carbon capture and storage (BECCS), carbon-neutral methanol, and carbon utilization. Hydrogen fuel cell technologies and hydrogen transport infrastructure received the largest allocation of the FECM budget, which dedicated $105 million for research, development and deployment. It is important to note that some of the funds in this new legislation cannot be spent until the start of fiscal year 2022 (October 1st).

Table 1: Enacted FY 2022 appropriations for the US Department of Energy: Office of Fossil Energy and Carbon Management (FECM). Source: Adapted from the Carbon Capture Coalition

Looking Ahead: Deploying Decarbonization at Scale

Prior to the passage of these policies, the most influential U.S. federal policy that supports carbon capture and sequestration (CCS) is Section 45Q of the U.S. Tax Code, which allocates up to $50 per ton for the geological sequestration of carbon dioxide. President Biden’s Build Back Better Act, which passed the U.S. House in November 2021 and is awaiting approval in the U.S. Senate, includes a proposal to increase the value of this tax credit to $85 per ton for carbon sequestration. Additionally, this Act would introduce a production tax credit of $3 per kilogram of clean hydrogen and an investment tax credit that would cover up to 30% of the cost of equipment needed to produce clean hydrogen. The absence of these incentives in the IIJA and the omnibus bill was a missed opportunity to make CCS and hydrogen more profitable, particularly as the likelihood of the Build Back Better Act passing decreases.

Not only do these policies provide the necessary support for advancing the CDR market, they also demonstrate the federal government’s commitment to its climate and decarbonization goals. These policies have elevated the profitability of the CDR market in the U.S., a profitability that will only increase with the recent SEC climate-related risk disclosure proposal. While the IIJA and the omnibus budget package are historical in scale of investment, this should only be the beginning of the federal government’s long-term investment in the CDR market. The World Resources Institute determined that the U.S. “must make large-scale investments in carbon removal – up to $6 billion per year in federal funding over the next 10 years, with continued support for scaled deployment beyond 2030”.

A Note on the SEC Climate-Related Risk Disclosure Ruling

On March 21st, the U.S. Securities and Exchange Commission (SEC) approved a proposed rule that would require all registrants, including foreign-based firms, to disclose in their annual financial statements the climate-related risks that:

Have had or will have a material impact on its business in the short-, medium-, or long-term,

That have or are likely to result from the registrant’s strategy, business model, and outlook,

The registrant’s processes for identifying, assessing, and managing these climate-related risks, and

The registrant’s climate-related risk management strategy.

The SEC modeled the climate-risk disclosure framework in this proposal from that of the Task Force on Climate-Related Financial Disclosures (TCFD). All registrants are to report their direct (Scope 1) and indirect (Scope 2) GHG emissions, as defined by the Greenhouse Gas Protocol. Some registrants may be exempt from including their indirect emissions from upstream and downstream activities (Scope 3). If applicable, this rule would also require the registrant to disclose internal carbon prices and details on the registrant’s public-facing climate-related targets or goals (including the purchase of carbon offsets or renewable energy certificates (RECs)).

This proposal is now undergoing public comment. If the proposal is adopted by December 2022, the requirement of climate-related risk disclosures in annual financial statements will be phased in beginning with all disclosures, including GHG emissions Scope 1 and 2. An extended period will be granted for the inclusion of Scope 3 emissions. See the SEC’s fact sheet for an overview of the proposal’s phase-in periods.

The passage of this proposal is historic. If it is adopted, it will be the first time the SEC is requiring its registrants to report on the climate risks associated with their business operations and management.

The intentions behind this proposal are to protect investors by enhancing and standardizing climate-related risk disclosures, but the CDR industry as a whole will benefit from this rule as transparency will increase demand for high quality CDR projects. Additionally, this demand will lead to significant growth in the emissions accounting industry. This is a landmark example of how a government agency can simultaneously protect private interests and guide stakeholders on a path towards a clean transition in an efficient and effective manner.

As a carbon management firm that advises corporations on how to most effectively realize their carbon commitments, Carbon Direct has paid close attention to policy developments that support carbon management in the U.S. and abroad. The latest ruling from the SEC underscores the importance of high-quality carbon removal more than ever – as corporations move towards disclosing their Scope 1 and 2 emissions, they must then neutralize them. That is why we believe that frameworks like our Criteria for High-Quality Carbon Dioxide Removal, developed in partnership with Microsoft, can help to inform both state-level and federal regulation.

From carbon footprinting to risk mitigation to carbon removal procurement, learn more about Carbon Direct Inc.’s advisory services here.[1][2]

1. World Resources Institute (2020), CarbonShot: Federal Policy Options for Carbon Removal in the United States. https://www.wri.org/research/carbonshot-federal-policy-options-carbon-removal-united-states

2. U.S. Securities and Exchange Commission (2022), Factsheet: Enhancement and Standardization of Climate-Related Disclosures. https://www.sec.gov/files/33-11042-fact-sheet.pdf

Tags

Carbon Removal

Climate Policy